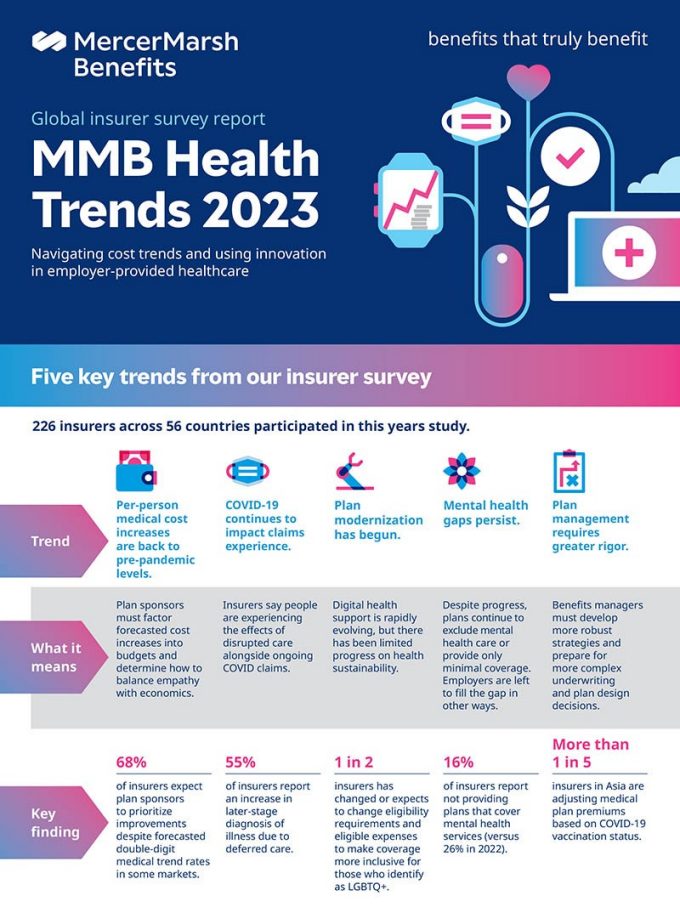

MMB Health Trends 2023

De beste trendene som former helseomsorg levert av arbeidsgiver

MMBs globale undersøkelse av 226 forsikringsselskaper i 56 land identifiserte fem sentrale temaer som driver kostnader og risiko i helsemessige ansattgoder.

Disse trendene er viktige for arbeidsgivere å vurdere som mens mange bedrifter har breddegrad i å designe deres ansattgoder for å møte deres behov, spiller forsikringsselskaper en nøkkelrolle i å forme fremtiden for ansattgoder. De gjør dette gjennom deres standard praksis og policyspråk, deres vilje til å vedta nye bestemmelser og deres tilgang til store grupper av kravdata.

Et betydelig antall forsikringsselskaper legger til innovative funksjoner til medisinske produkter, for eksempel digitale helse- og selvpleieverktøy, til måter å koble personer med bedre kvalitetspleie.

Last ned rapporten om helsetrender

MMB helsetrender 2023

Få en grundig titt på de nyeste medisinske trendene og lær hvordan du kan svare på dem ved å laste ned hele rapporten.

MMB Health Trends 2023 Infographic

En bittstor oversikt over de viktigste funnene fra årets forskning.

Innovasjon for forsikringsselskaper er ett sølvfôr av COVID-19

COVID-19 har hatt betydelige kortsiktige og langsiktige konsekvenser for menneskers liv, helserisiko, kostnader og diagnose. Det har imidlertid også drevet forsikringsselskapet innovasjon og plan modernisering.

Relaterte løsninger

Relevant innsikt